Selling rental property tax calculator

Depreciation recapture tax rates. We assume three months of escrow property taxes but you can.

Tax Calculator For Rental Property Best Sale 50 Off Www Ingeniovirtual Com

We Analyze Home Sales To Find The Best Agents Near You.

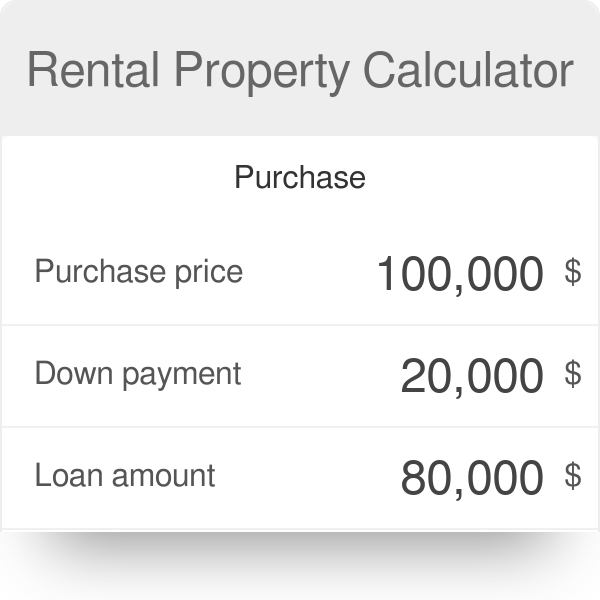

. Karl and Louisa bought a residential rental property in November 2016 for a purchase price of 750000. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. While the exact property tax rate you will pay for your properties is set by the local tax assessor you can estimate your yearly property tax burden by choosing the state and county in which.

We assume 15 days of pre-paid interest in our calculation but you can adjust this. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. The tax rate can vary from 0 to.

Ad Access Rankings For Free. So if your home is worth 200000 and your property tax rate is 4 youll pay about. Your rental earnings are 18000.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Capital gains on the sale of a co-owned rental property. Rental income tax breakdown.

Capital Gains x Tax Rate Depreciation x 25 Tax Rate. Avoid costly mistakes and continue making rental income. You can claim 1000 as a tax-free property allowance.

You collect rent monthly. This handy calculator helps you avoid tedious number-crunching but it should only be used for. Ad Learn 5 expert tips to selling your vacation rental without losing money.

Work out if you need to pay. Ad Easily File Your Rental Property Taxes. You cannot use the calculator if you.

On this website youll find out all you need to know about your property taxes - including tax rates in your state and county local property tax assessors. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Once you know what your gain on the property is you can calculate if you need to report and pay Capital Gains Tax.

See The Top 3 Agents Now. You earn equity in your home. Your investment property appreciates over time.

Rental property provides an investor with several potential passive income streams. You Report Revenue We Do The Rest. Unbiased Rankings Are Delivered Within Minutes.

Selling Price of Rental Property - Adjusted Cost Basis. As a result your taxable rental income will be.

How To Properly Report The Sale Of A Rental Property

How To Calculate Fl Sales Tax On Rent

Converting A Residence To Rental Property

Rental Property Calculator How To Calculate Roi

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

How To Calculate Rental Income The Right Way Smartmove

Investment Property Excel Spreadsheet Rental Property Investment Property Rental Property Investment

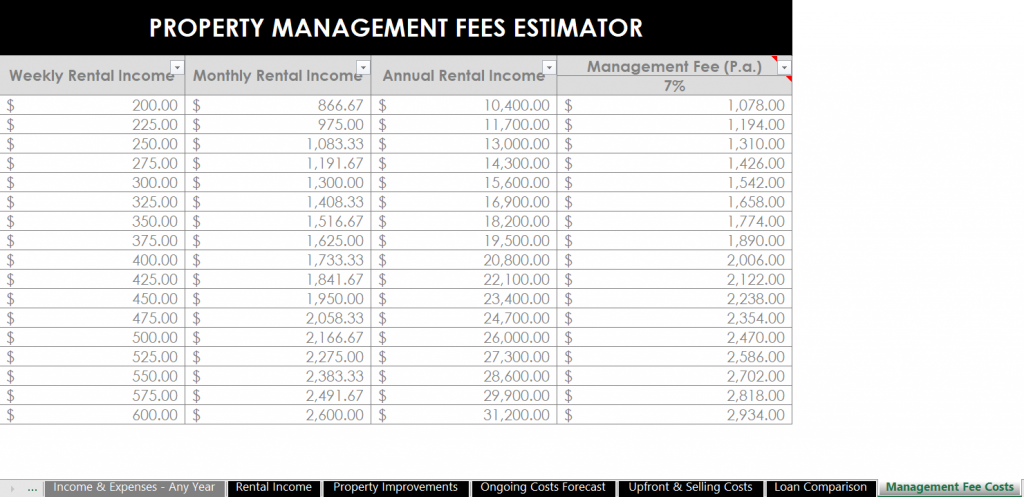

Rental Property Calculator Most Accurate Forecast

Pin On Financial Ideas

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Calculating Returns For A Rental Property Xelplus Leila Gharani

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Like Kind Exchanges Of Real Property Journal Of Accountancy

Passive Income Tax Rate What Investors Should Know 2022

Rental Property Calculator Most Accurate Forecast

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com